vermont state tax rate 2021

The 2022 state personal income tax brackets. These taxes are collected to provide essential state functions resources and programs to.

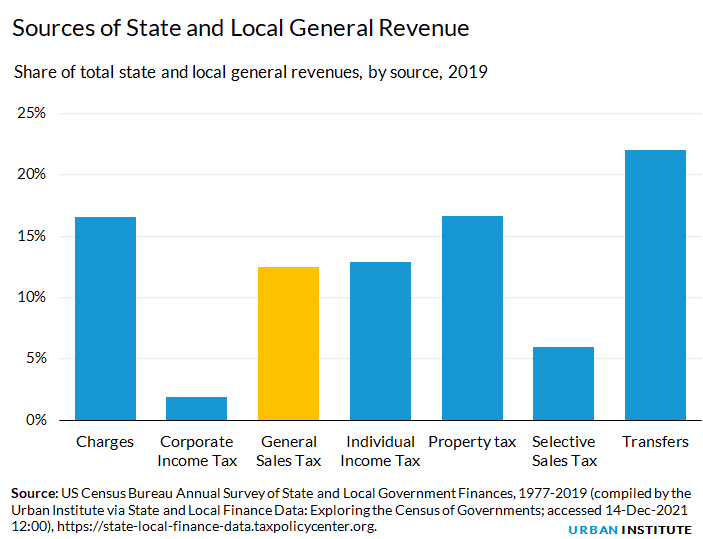

General Sales Taxes And Gross Receipts Taxes Urban Institute

Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on.

. Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. Vermont also has a 600 percent to 85. VT Taxable Income is 82000 Form IN-111 Line 7.

See Whats Been Adjusted For Income Tax Brackets In 2022 vs. Insights Try Payroll Trial. Any income over 204000 and 248350 for.

Vermont Tax Brackets for Tax Year 2020. At Least But Less Single Married Married Head of. Vermont Rooms Tax for Businesses.

Find your pretax deductions including 401K flexible account. Your free and reliable 2021 Vermont payroll and historical tax resource. Before sharing sensitive information make sure youre on a state government site.

In Vermont theres a tax rate of 335 on the first 0 to 40350 of income for single or married filing taxes separately. Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules. Before sharing sensitive information make sure youre on a state government site.

How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table. And your filing status is. Than filing filing house- jointly.

They vary based on your filing status and taxable income. Filing Status is Married Filing Jointly. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66.

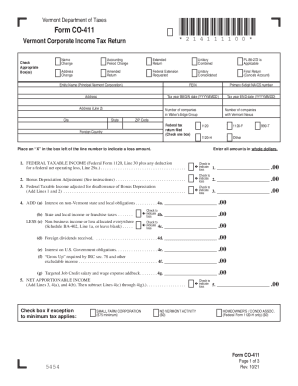

Provided the state does not have any outstanding Title XII. IN-111 Vermont Income Tax Return. Your 2021 Tax Bracket To See Whats Been Adjusted.

Explore data on Vermonts income tax sales tax gas tax property tax and business taxes. Download Avalara sales tax rate tables by state or search tax rates by individual address. As you can see your Vermont income is taxed at different rates within the given tax brackets.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. If Taxable Income is. Find your income exemptions.

Learn about Vermont tax rates rankings and more. TAX TABLES Place at. Vermont state tax 4514.

Ad Compare Your 2022 Tax Bracket vs. The Vermont Department of Labor announced that its fiscal year 2022 July 1 2021 June 30 2022 state unemployment insurance SUI tax rates are determined on Rate Schedule III with. The Vermont State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Vermont State Tax Calculator.

Vermont Meals Tax on Vending Machines. State government websites often end in gov or mil. What Is the Tax Rate in Vermont.

Calculations are estimates based on tax rates as of Dec. Vermont 2021 Tax Rates. Select year Select another.

2021 Vermont Tax Tables. State government websites often end in gov or mil. State government websites often end in gov or mil.

Vermont Income Tax Rate 2020 - 2021. Tax Rates for Cigarettes Tobacco. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes.

Vermont has four state income tax brackets for the 2021 tax year. Before sharing sensitive information make sure youre on a state government site. If youre married filing taxes jointly theres a tax rate of 335 from 0 to.

The major types of local taxes collected in Vermont include income property and sales taxes. Ad Top-rated pros for any project. Tax Rates and Charts Tuesday.

Where Is Vermont S Newly Approved 7 32 Billion Budget Going Vtdigger

Vermont State Tax Guide Kiplinger

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Department Of Taxes

Sales Taxes In The United States Wikipedia

Are There Any States With No Property Tax In 2022 Free Investor Guide

Vermont Income Tax Calculator Smartasset

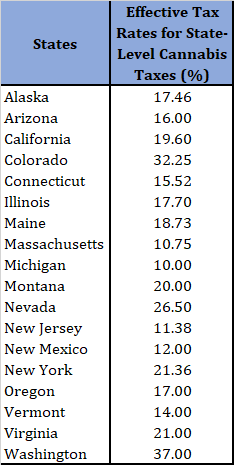

Assessing State Level Adult Use Cannabis Taxation Aaf

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes

Vermont State Tax Software Preparation And E File On Freetaxusa

Novel Coronavirus Covid 19 Vermont State Response Resources Office Of Governor Phil Scott

Historical Vermont Tax Policy Information Ballotpedia

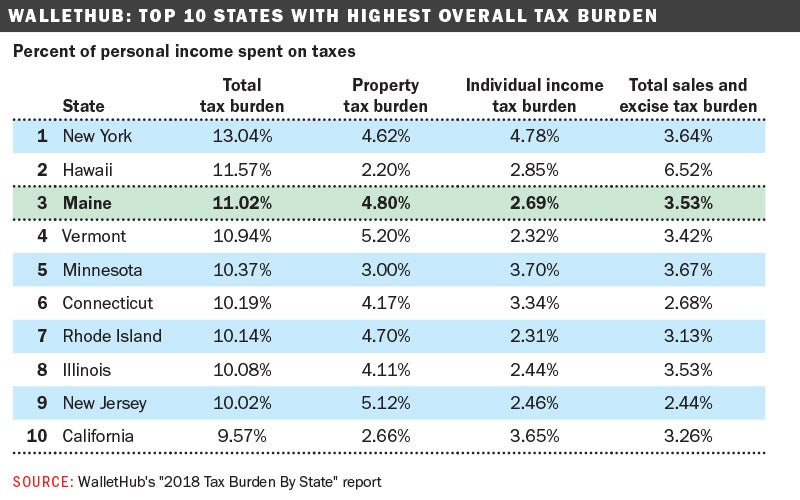

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

The Most And Least Tax Friendly Us States

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

New Report Vermont S Tax System Is Among The Least Regressive Public Assets Institute

States With The Highest Lowest Tax Rates

Vermont Co 411 Fill Out And Sign Printable Pdf Template Signnow